As a Financial Planner, I often find that many workers place a strong focus on “maxing out” (contributing the maximum allowable amount) their annual retirement plan contributions. This brings up a common question – if you are maxing out your 401k or 403b…does that mean you will be able to retire safely?

The short answer is maybe…and maybe not. Let’s explore some details that can add some color to this question.

Maxing out the 401(k)/403(b)

This is a tempting goal – if you max out your 401(k)/403(b) does that mean you are saving the maximum you can towards retirement? No. It means you are saving some money for retirement while deferring taxes on a portion of your income (for now). This may not serve you for two reasons:

- It may actually be in your benefit to pay some taxes now rather than waiting until you are retired.

- You may need to save more than the allowable deferral to meet your retirement goals.

Taxes now vs. taxes later

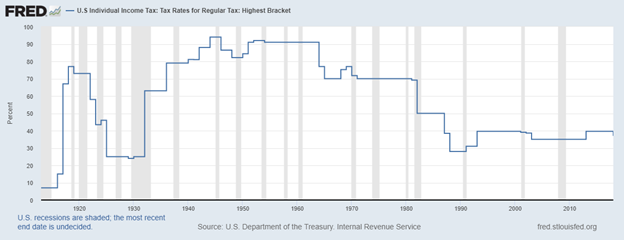

There is an oft repeated belief that it is better to defer your taxes and pay at a later date. This may not always be true – for some, this strategy is just like kicking the can down the road. Saving for retirement exclusively through your qualified retirement accounts can lead you down a path to limited flexibility related to taxes during retirement. When you are working, you may have dependents to care for and mortgages to pay – which can help with tax deductions now. However, in retirement it can be difficult to find deductions. Furthermore, tax rates in the future are unknown, and our current tax rates are historically low. The below chart reviews tax rates for the highest tax bracket in the US over time.

U.S. Department of the Treasury. Internal Revenue Service, U.S Individual Income Tax: Tax Rates for Regular Tax: Highest Bracket [IITTRHB], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IITTRHB, July 15, 2021.

Interesting note – the income level that corresponds to the highest tax bracket is a moving target. For example, in 2018 the highest bracket applied to those making more than $600,000 per year, whereas in 2001 the highest bracket applied to those making more than $297,350 per year. My point is – it is worth a thoughtful conversation about your current tax rate, and what tax rate you are comfortable with, to decide how much of your income you want to defer. You can take control of your tax rate during your working years by deciding how much you want to defer and how much you are comfortable paying tax on now. It may be beneficial for you to have more diversification in your tax rates in retirement.

A note about deferrals – they aren’t forever. We are required to take out a percentage of our deferred retirement accounts starting at age 72 due to a Required Minimum Distribution (RMD).[1] This is a percentage of your retirement account that you must take out every year, it begins at about 4% of the account value. If you have only saved into qualified retirement accounts, then your central source of income in retirement is going to be fully taxable. So, if you aren’t careful you can end up with a large tax deferred account that puts you in a higher tax bracket in retirement than when you were working.

Is my 401(k)/403(b) contribution enough?

The maximum deferral into your retirement accounts may or may not be enough to retire. The answer to this question depends on various factors including how much you want to spend annually in retirement, when you plan on retiring, and what your other sources of income might be available to you in retirement. Experts often say that you should be saving 20% of your income for retirement. If we believe that to be true, then those who are making $97,500 and who defer the maximum of $19,500 into their retirement account are on track. For those making more than $97,500, they will need to explore other avenues to save for retirement, while those who are making less than $97,500 may not need to aim for maxing out their contributions. We can review your savings rate together during the financial planning process to discern what the correct savings rate is for you.

Thinking creatively about your savings

There are many ways to save for retirement – let’s break it down into steps.

Step one – figure out how much you need to save.

Step two – identify which vehicles will allow you to meet that savings goal in the most effective way.

You can use your 401(k)/403(b) strategically to defer some income and get your employer match (if they offer one). You might explore using a Roth 401(k)/403(b) option to diversify your tax situation. You could contribute to an after- tax brokerage account. These accounts can have annual tax burdens on capital gains, but you don’t have to make withdrawals on anyone’s timeframe other than your own. Your retirement savings plan is not limited by your 401(k)/403(b) – let’s work together to find the best combination of options that works for your situation – and reevaluate as tax law and your income changes.

[1] Note – the SECURE Act, passed in 2019 increased this age. Prior to that, it was 70.5.

This content is developed from sources believed to be providing accurate information, and provided by ReFrame Wealth, LLC. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.