As I reflect on the start of a new year, I am struck by how much has changed, and how much stays the same. ReFrame Wealth was born in 2021 with the vision of changing the way wealth management feels – a new firm to solve an old problem. Plenty of experts agree that increased financial wealth does not correlate to increased feelings of happiness or satisfaction. So, if acquiring wealth in the traditional sense doesn’t make us feel safe and happy – what does?

Join me this year in setting an intention: I will hold my wealth lightly. Those who can metaphorically hold their assets with an open palm instead of a gripped fist tend to be more satisfied with life in general. Releasing the anxiety and sense of scarcity that many of us associate with money allows us to focus our energy on the other things in life that drive meaning, purpose and even joy. But the process of disentangling our selves from our money can feel impossible, but I promise you can do it. Achieving this outcome requires a change in mindset and action.

Mindset

- Detach your worth from your balance sheet.

- Appreciate what can be controlled and what can’t.

Action

- Engage in responsible financial planning.

- Outsource the strategy and work to professionals who care as much about your future as you do.

Detachment

Changing your mindset around money means knowing – in your bones- that your personal value is not linked to your net worth. This requires undoing our reflex to link happiness to the new car, or the new house, or the next shiny object. The truth is that you are separate from your funds – and the more you can delineate between the two, the healthier your relationship with money becomes. Excess funds allow you the freedom to do things (or not) and provides you with financial security (or not). But even as your account balance may rise and fall, you are still you. The daily heartaches and joys of being human continue regardless of wealth. If you examine your history with money, I’m willing to bet you’ve experienced ups and downs in the value your accounts. Think about the person you were during the ups and then again during the downs. Perhaps also consider that the future will inevitably hold more ups and downs…and you will weather those as well. When you unravel this interconnectedness between your person and your wealth, you will have mastered the first step towards feeling lighter and more empowered in your relationship with money.

Control what you can…

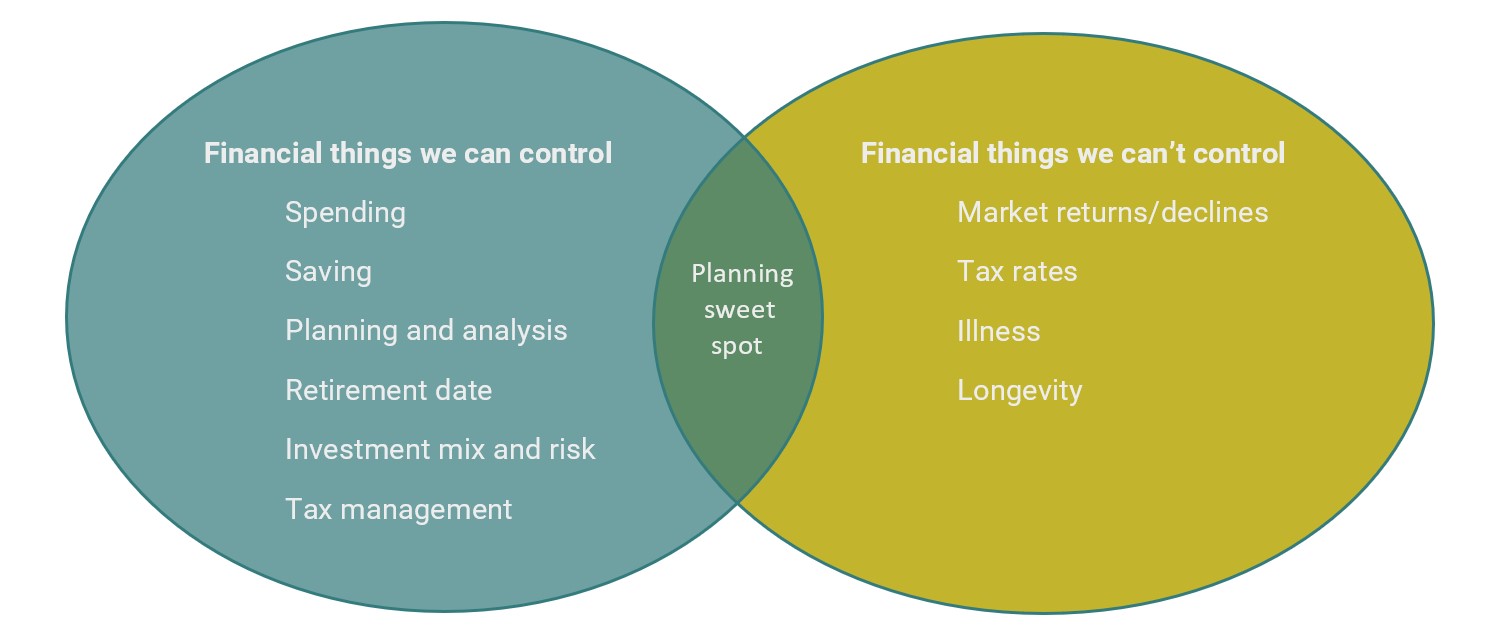

The illusion of control can be powerful and tempting. It can be helpful to name the things that can be controlled that those that can’t; in financial planning, there is a healthy mix of both. I find those who understand and focus their energy on the things that can be controlled and release the rest, feel much more empowered about their funds. Releasing the things we can’t control, doesn’t mean ignoring them. It means being aware of and prepared for many different scenarios without obsessing over them.

Responsible Financial Planning

Trying to manage the complexities of your financial future without a plan is stressful. A financial plan can offer data to help shape the decision-making process. It can use analysis to map out likely scenarios as you get from here to where you want to be. You may breathe easier knowing that you have examined all the corners of your finances and have a plan for how to address them long term.

Professionals can help

When you engage the help of a professional, you add a teammate to your roster. A strong partnership with a planner can provide space for you to ask the questions that keep you up at night, and explore solutions to fill in the gaps. At ReFrame Wealth, we have been doing this work for years, so we can add perspective to the issues that are important to you. Most of all, we can walk alongside you as you make important financial decisions for your family and we can implement those decisions with you or for you. Working with a professional means you will be guided and supported in every stage of your financial life.

In summary – holding wealth more lightly is possible. It requires changes in both attitude and actions and can lead to a healthier relationship with money and greater satisfaction in life. In 2022, my hope is that you find ways to examine your feelings about wealth and reimagine what your money can means for you.

This content is developed from sources believed to be providing accurate information, and provided by ReFrame Wealth, LLC. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.