Tax-Loss Harvesting: The basics, the benefits and what investors should consider

Tax-loss harvesting has become an increasingly useful tax management tool for investors, especially in volatile market environments. Here, we’ll explore how tax-loss harvesting works, what the possible benefits are, and what specific risks investors should consider.

What is tax-loss harvesting and how does it work?

Tax-loss harvesting is a tax management strategy that is popular among investors and portfolio managers. When implemented properly, the strategy can provide positive financial impact. By selling investments at a loss today, investors can offset capital gains (and up to $3,000 of ordinary income) on other investments sold at a profit. While tax-loss harvesting does not eliminate taxes altogether, its true value lies in the opportunity to lower current tax liabilities and allow for growth of those savings over time. Consider this brief example:

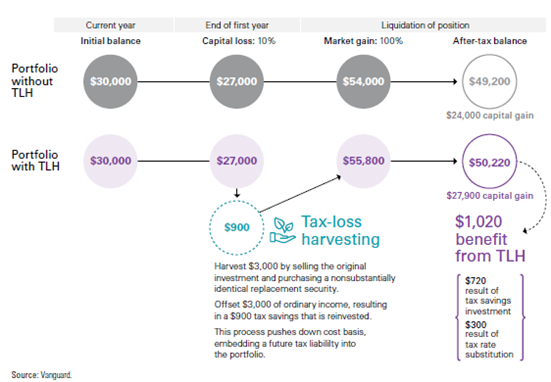

Portfolio without tax-loss-harvesting: In the first case, we see a $30,000 investment value drop to $27,000 but then recover and grow, since the investor chose to stay the course, rather than sell. Eventually, the investment value grows to $54,000, when the investor decides to liquidate (sell). The net value of this investment is $49,200, after capital gains taxes are paid on the sale ($54,000 – capital gains tax of 20% x capital gain of $24,000).

Portfolio with tax-loss harvesting: The second case reflects the potential benefits of tax-loss harvesting. We can see that at the end of the first year, the investment has declined 10% to $27,000. The investor wants to stay the course but also wants the potential tax benefit of showing a loss on their tax-return. This investor chooses to sell the investment at a $3,000 loss and purchase another investment right away as a replacement. The replacement investment allows the investor to stay invested in the market while also capturing a taxable loss. The $3,000 loss can offset an equal amount of realized gains or taxable income that year. At a 30% income tax rate, the investor can reduce their taxes by $900 that year as a result of this strategy. In this example, we assume the investor reinvests the $900 tax savings and allows it to grow for the future. The end result is an after-tax value of $50,220 ($55,800 – capital gains tax of 20% x capital gain of $27,900).

What are the benefits of tax-loss harvesting?

In our example above, the tax-loss harvesting strategy produced an after-tax benefit of $1,020, thanks to two beneficial components. First, investors may benefit from realizing a tax loss that can reduce what is owed in taxes that year. Second, the investor may generate additional asset growth by reinvesting the $900 tax savings.

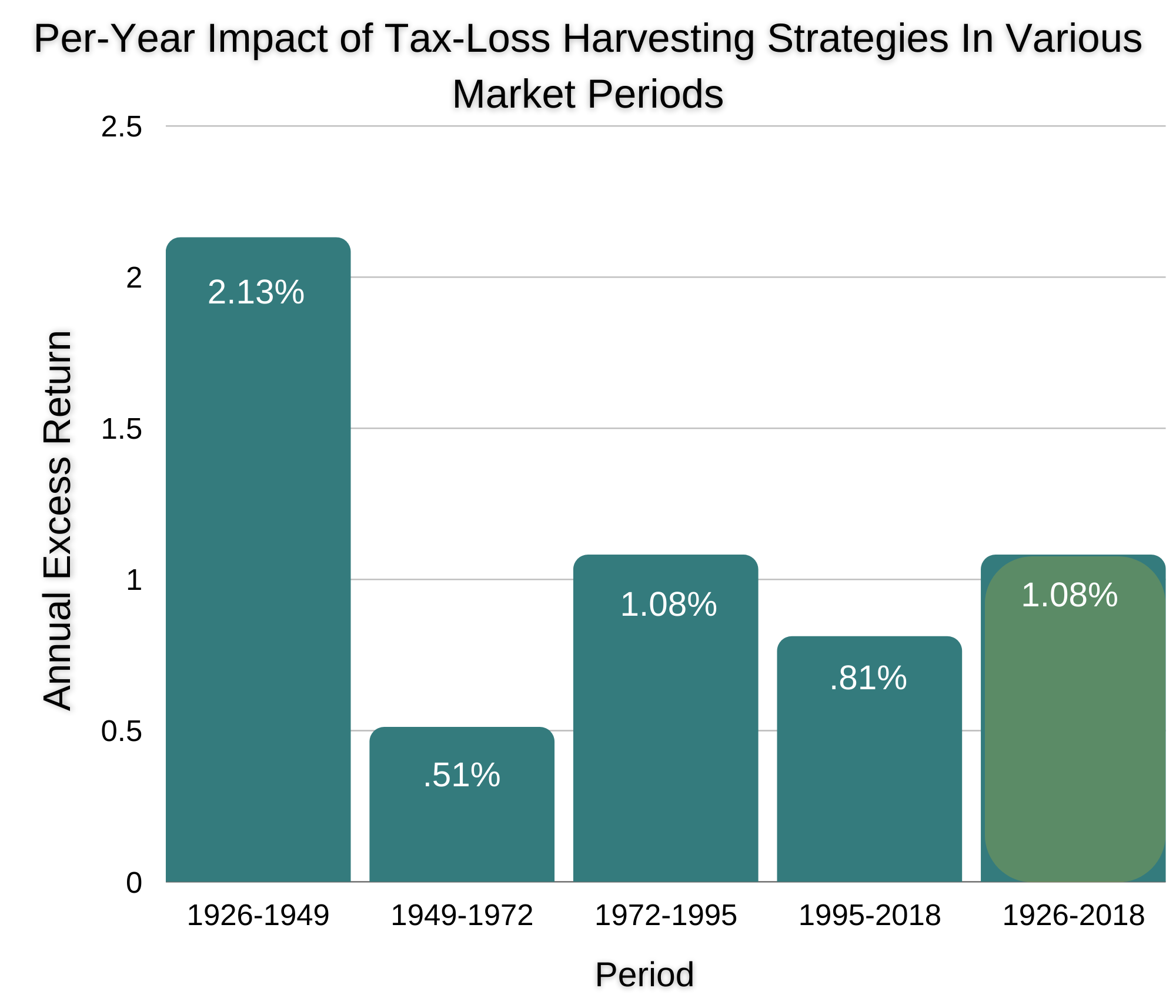

According to an empirical evaluation of tax-loss harvesting printed in the Financial Analysts Journal, the estimated benefits of an intentional tax-loss harvesting strategy has historically yielded a beneficial portfolio impact of 1.08 % per year. The study also identifies a greater impact to portfolio returns when tax-loss harvesting strategies are deployed in periods of increased market volatility.

Source: Shomesh E. Chaudhuri, Terence C. Burnham & Andrew W. Lo (2020) An Empirical Evaluation of Tax-Loss-Harvesting Alpha, Financial Analysts Journal, 76:3, 99-108,

Source: Shomesh E. Chaudhuri, Terence C. Burnham & Andrew W. Lo (2020) An Empirical Evaluation of Tax-Loss-Harvesting Alpha, Financial Analysts Journal, 76:3, 99-108,

DOI: 10.1080/0015198X.2020.1760064Parametric: How Does Tax-Loss Harvesting Work?

What are the risks of tax-loss harvesting?

While the potential benefits of tax-loss harvesting are clear, there are several risks that must also be considered. When implementing a tax-loss harvesting strategy, investors must weigh a variety of variables, including performance disparities between target and substitute securities, future changes in tax rates, and execution risk.

One of the primary hazards associated with tax-loss harvesting is triggering something called the wash-sale rule. Under the IRS wash-sale rule, an investor cannot realize a loss on investment if they replace it with a “substantially identical” investment within 30 days. If violated, the investor will not be allowed to receive a tax benefit from this strategy. Prudent investors will replace the investment with an appropriately similar investment that does not cross the line into “substantially identical.”

Another risk of a tax-loss harvesting strategy is called execution risk. Execution risk refers to the various choices an investor must make during the implementation of the tax-loss harvesting strategy. Investors must identify the optimal time to effectively execute their strategy. Another important factor is whether to sell all or some of an investment that has declined. Selecting the right substitute investment to replace the sold investment in the portfolio is also critical. Consulting with a professional portfolio manager or financial planner before engagin in a tax-loss harvesting strategy is a smart idea.

What’s the big picture with tax-loss harvesting?

While tax-loss harvesting can be a useful tax management tool for investors, there are many factors to consider when implementing the strategy, yourself. The value of a thoughtful tax-loss harvesting strategy is clear, but it also comes with potential pitfalls that should be carefully considered. Investors are encouraged to examine these issues thoroughly or seek the professional guidance of qualified tax or financial planning professionals before proceeding with a tax-loss harvesting strategy.

This content is developed from sources believed to be providing accurate information, and provided by ReFrame Wealth, LLC. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.