Mutual Funds or ETFs?

If you’ve been an investor during the last 20 years, you’ve probably heard of Exchange Traded Funds or ETFs. These funds are known for being inexpensive, tax efficient, and accessible. Many investors are also drawn to ETFs because they’ve heard that ETFs are “better” than more traditional mutual funds. But are ETFs always better?

Like most things related to investing, the correct answer is nuanced, with distinct pros and cons for both mutual funds and ETFs. We believe investors can be well served using either structure, or a combination of investment vehicles. With that in mind, ReFrame Wealth builds portfolios with funds that take tax efficiency and lower expenses into account, even when using mutual funds.

Before we dive into analyzing these two investment vehicles, a little background may be helpful. In simplest terms, both mutual funds and ETFs are structures that may invest in stocks, bonds, or a combination of both. ETFs trade on an exchange like stocks while mutual funds trade directly with the fund provider. Both structures can give investors an efficient and low-cost way to access capital market returns.

While many aspects of ETFs and mutual funds are hard to differentiate, four characteristics are worth exploring:

• Trading Costs

• Operating Expenses

• Tax Efficiency

• Unexpected Outcomes

Trading Costs

The most commonly discussed trading costs are commissions, which have been under pricing pressure for years. ETFs now trade commission-free with many institutions, while some, but not all mutual funds trade with a small fee. Depending on the type of accounts you have, those trading fees may be passed on to you, the investor, or paid for by your portfolio management team.

However, commissions are not the only trading costs that need to be considered. The price you pay – or the proceeds you receive- when buying and selling funds will be calculated differently for mutual funds than for ETFs. Mutual funds are priced using a calculation called “Net Asset Value”, or NAV. NAV most closely tracks the value of the companies held in a mutual fund by incorporating the stock price of each company in the fund, any assets and liabilities, and the total outstanding shares of the fund. Also built into the NAV is an expense ratio that covers the cost of managing the fund. Expense ratios are disclosed by fund managers every six months and can be easily found on fund fact sheets or through your financial planner.

Meanwhile, ETFs trade with an exchange dealer at the bid/ask prices. Bid/ask pricing is essentially pricing set by an exchange dealer, who decides what he or she is willing to pay for an ETF based on several factors including what he or she thinks the ETF can be sold for. The exchange dealer will attempt buy (bid for) an ETF for LESS than the dealer thinks it can be re-sold for. Similarly, the dealer will attempt to sell (ask for) ETF shares for MORE than the dealer paid. This difference between the bid price and the ask price is referred to as the “spread”. The spread can be considered the primary trading cost when it comes to ETFs. Spreads change daily and can be relatively low for some ETFs at .002%, or relatively significant for others, upwards of .45%. ₁

Depending on commissions, fund expense ratios, and ETF spreads (among other considerations), you may find that the costs incurred with mutual funds may be lower than you would pay for ETFs. Surprising but true!

Premium/Discounts

In addition to the spread, investors need to be aware of an ETF’s premium and discount. As the name implies, a premium exists when ETF’s price is higher than the fund’s NAV or the value of its underlying securities. A discount exists when the ETF’s price is less than the NAV. Depending on whether you are buying or selling, a premium or discount can help or hurt.

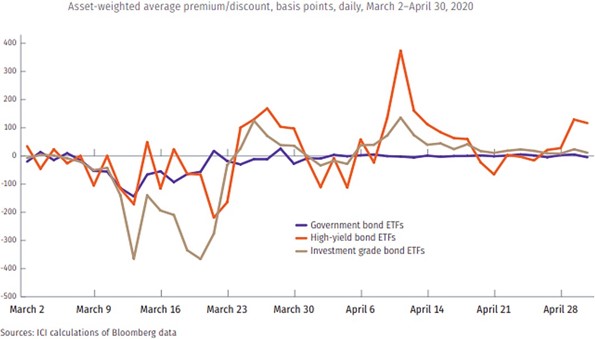

Premiums and discounts need to be monitored as they change daily and can be volatile, particularly in unstable market environments. For example, during “Peak Covid” in early 2020, many fixed income ETFs traded at a material discount to their NAV as shown by the chart below.

For investors wishing to sell fixed-income ETFs in March of 2020, the price they received would have been less than the value of the bonds in the portfolio. This difference in price vs. value is nothing to skim over. ETF investors must be aware of the premium and discount when trading as these factors may present yet another cost that must be considered. In contrast, mutual funds trade at a single NAV price at the end of the day, so there is no premium or discount to contend with.

Operating Expenses

In addition to spreads and premiums/discounts, investors should be aware of a fund’s operating expenses. The operating expense is simply what the fund company charges to create and manage the fund. It is a fee paid directly from the fund’s assets or more correctly stated – investors’ assets.

ETFs made their hay 20 years ago by offering significantly lower costs, compared to prevailing mutual fund fees at the time. As the relationship between fees and performance became well understood, investors flocked to the lower-cost ETF structure causing investment in ETFs balloon. In order to remain competitive to investors, mutual fund providers had no choice but to follow suit and lower their fees – capitalism at work!

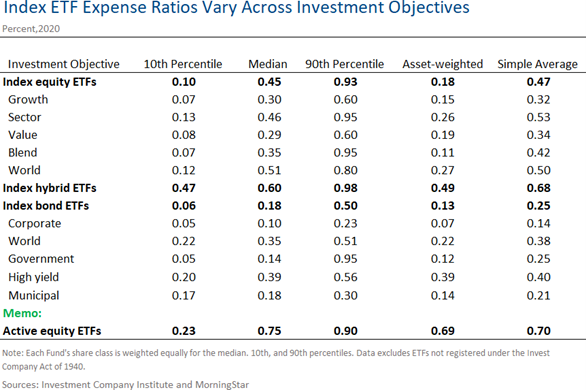

These days, high-cost offerings in both structures can still be found, as shown from the 2020 Investment Company Institute Factbook, the lowest cost active equity ETFs assess fees of approximately .23% with the median being .75% and the most expensive costing almost .9% (see below).

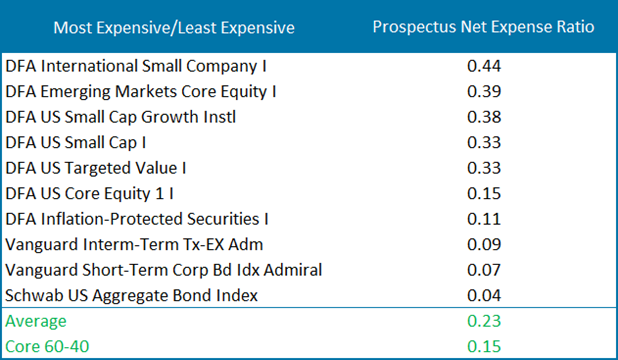

There is likely no greater benefit of the ETF structure than its record of driving management fees lower and saving investors billions of dollars over the past 30 years. As a result, investors today can find low-cost, competitively priced options in both ETFs and Mutual Funds. The average net expense ratio of the most commonly utilized mutual funds in ReFrame Wealth portfolios is .23% – very much in line with the lowest cost (10th percentile) Active Equity ETFs (see below).

Source: Morningstar Direct

Source: Morningstar Direct

Tax Efficiency

One of the most commonly purported benefits of ETFs is their tax efficiency. Due to the ETF structure, a majority of ETF funds will not make annual capital gain distributions, which may minimize the impact of investment related year-end tax liabilities for investors. The mechanics behind how ETFs do this (the in-kind creation/redemption process) is beyond the scope of this paper. Unfortunately, like trading costs, this unique benefit is often over-simplified and does not reflect the whole story.

First, the tax efficiency of any strategy will be strongly related to its investment approach. Low turnover, broadly diversified strategies inherently will lend themselves to being tax efficient. Up until the SEC adopted the ETF rule in 2019, virtually all ETFs were tax-efficient index strategies giving them a natural advantage over their actively managed, higher turnover mutual fund peers. This helped set in motion the dogmatic belief that ETFs are materially more tax efficient. Regardless, extremely tax-efficient mutual funds can be found. The smaller their distributions become; the more ETF’s tax-advantaged structure will be marginalized.

Second, ETFs allow for tax-deferral, not tax avoidance as some investors believe. Per KMPG “The deferral of gains at the ETF level using in-kind redemptions for appreciated securities generally doesn’t alter the total amount of taxable gain to be realized when the shareholder ultimately sells or redeems his or her ETF shares” ₂.

In short, mutual fund capital gains have a sort-of “pay as you go” nature, with what may sometimes be a higher annual tax liability, but a potentially lower capital gains tax liability at the time of sale. With hundreds of millions of dollars of tax revenue at stake every year, one can be assured that the IRS is not handing out free passes to ETF investors.

The ETF’s tax-deferral does have some additional potential benefits, such as the investors’ ability to control when that liability is created (at the sale) and the growth potential of retaining the deferred tax liability within the investment.

Unexpected Outcomes

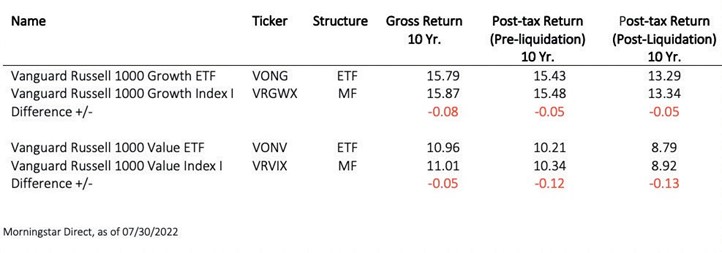

Most investors want the same thing, reasonable risk, and tax-adjusted returns for the lowest possible cost. Despite their best intentions, investors can end up with the opposite outcome. Consider the investor who wanted to move from a mutual fund structure to an ETF structure in the funds listed below.

The funds are identical in every respect except structure. The same fund company (Vanguard) manages both, has the same strategy, and tracks the same benchmark. Yet the ETF has underperformed the Mutual Fund’s gross return, post-tax return (pre-liquidation), and post tax return (post liquidation) over the measured 10-year period – not the outcome the investor probably expected.

Conclusion

The capital markets are always innovating and changing as new products are being introduced daily. Today, there are more mutual funds (7,481) and ETFs (2,632) available than there are publicly traded stocks (6,374 on the NYSE and Nasdaq)₃. With so many offerings, investors can find extremely competitive, low-cost, tax-efficient funds in either structure.

For ReFrame Wealth investors, we are always evaluating and currently favor the traditional mutual fund over the ETF as a primary investment vehicle. The mutual funds we recommend, carry a tax, cost, and other justifications for inclusion in our clients’ portfolios. Of course, nothing is absolute and sometimes a data point may favor an ETF, which we will gladly incorporate. We remain confident that investors are being well served to continue to use the traditional mutual fund structure with ETFs introduced in appropriate cases.

₁ https://www.etf.com/etf-education-center/etf-basics/understanding-spreads-and-volume

₂ https://assets.kpmg/content/dam/kpmg/us/pdf/etf-tax-efficiency-web.pdf

₃ As of August 2023.

This content is developed from sources believed to be providing accurate information, and provided by ReFrame Wealth, LLC. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.